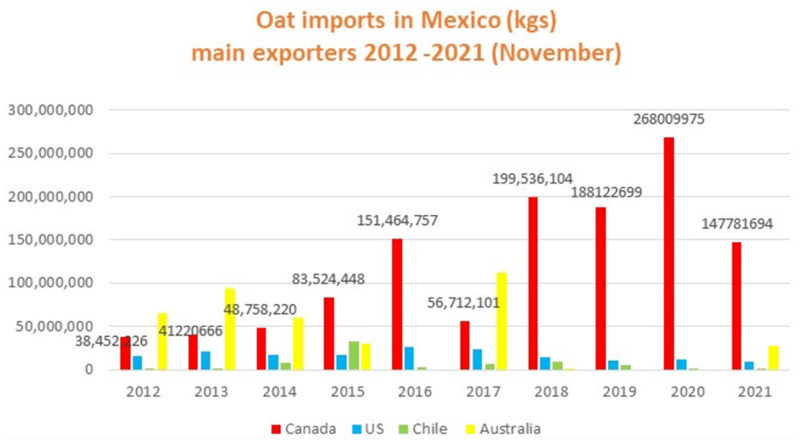

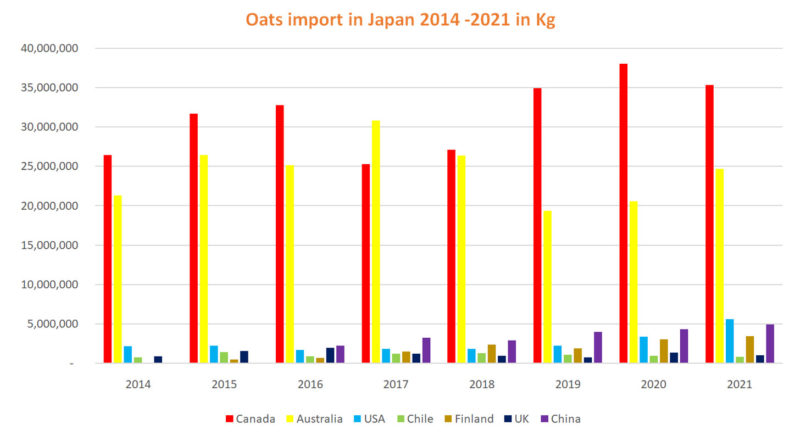

Market Development is a core function of POGA. Canadian oat exports have been growing significantly higher in Mexico and Japan due to POGA’s outreach to importers and social media campaigns directed at consumers. Additional success in Mexico has been through an annual recipe contest, as well as outreach aligning with World Diabetes Day.

In 2020, POGA also launched a social media campaign targeted at Canadian consumers which aimed at promoting the healthy aspect of introducing oats into everyday foods.

POGA has marketing projects in:

Mexico

Canada

Read more about the growth of these markets in the highlights below!

The primary goals of the marketing initiatives are to:

- Promote Canadian oats and oat products that increase value;

- Expand markets; and,

- Provide greater returns to producers.